A Thorough Check Out the Functionality and Benefits of Applying a Payment Portal

The implementation of a settlement entrance represents an important advancement in the world of digital transactions, providing organizations not only improved safety and security however likewise a much more reliable handling system. By incorporating functions such as multi-payment support and real-time purchase capacities, organizations can significantly enhance client complete satisfaction while decreasing the threat of cart desertion.

Understanding Settlement Gateways

The significance of modern ecommerce pivots on the smooth assimilation of repayment gateways, which work as the essential conduits between customers and merchants. A repayment entrance is a modern technology that helps with the transfer of information between a payment website (such as an internet site or mobile app) and the bank. This system ensures that delicate data, consisting of bank card information, is firmly sent, therefore keeping the integrity of the purchase.

Settlement portals are crucial for refining on-line repayments, making it possible for customers to total acquisitions successfully while providing sellers with an automated service for handling economic transactions. They sustain different payment techniques, consisting of credit scores cards, debit cards, and alternate repayment options, dealing with varied customer choices.

Moreover, repayment gateways boost the total shopping experience by using attributes such as real-time transaction handling and fraudulence detection mechanisms. Comprehending the capability of repayment entrances is vital for any company looking to prosper in the affordable landscape of on-line retail.

Trick Functions of Repayment Entrances

An extensive understanding of payment entrances also entails identifying their key attributes, which considerably improve both capability and user experience. Among the primary functions is deal handling rate, which enables sellers to total sales quickly, thereby lowering cart desertion rates. Additionally, payment entrances promote a wide variety of payment approaches, consisting of credit score cards, debit cards, and digital budgets, accommodating a diverse customer base.

One more vital feature is the easy to use user interface, which streamlines the repayment procedure for consumers, making it accessible and instinctive. This convenience of use is complemented by robust integration capacities, making it possible for smooth connection with numerous e-commerce platforms and point-of-sale systems. Numerous settlement entrances use adjustable checkout experiences, enabling services to line up the repayment procedure with their branding.

Real-time coverage and analytics are additionally essential attributes, offering vendors with understandings right into deal trends and client actions, which can educate company methods. Scalability is a necessary characteristic, permitting settlement gateways to expand alongside a company, accommodating enhanced deal volumes without endangering performance - 2D Payment Gateway. Overall, these essential functions highlight the importance of choosing a payment gateway that aligns with service demands and enhances the overall consumer experience

Security Procedures in Repayment Handling

Making certain safety in settlement handling is vital for both consumers and merchants, as it safeguards delicate financial info against fraud and cyber threats. Settlement gateways utilize multifaceted security steps to produce a durable framework for secure purchases.

In addition, settlement portals use Secure Outlet Layer (SSL) technology to develop protected links, even more protecting data traded in between the vendor and the consumer. Tokenization is another critical procedure; it replaces sensitive card details with an one-of-a-kind identifier or token, reducing the danger of information violations.

Benefits for Companies

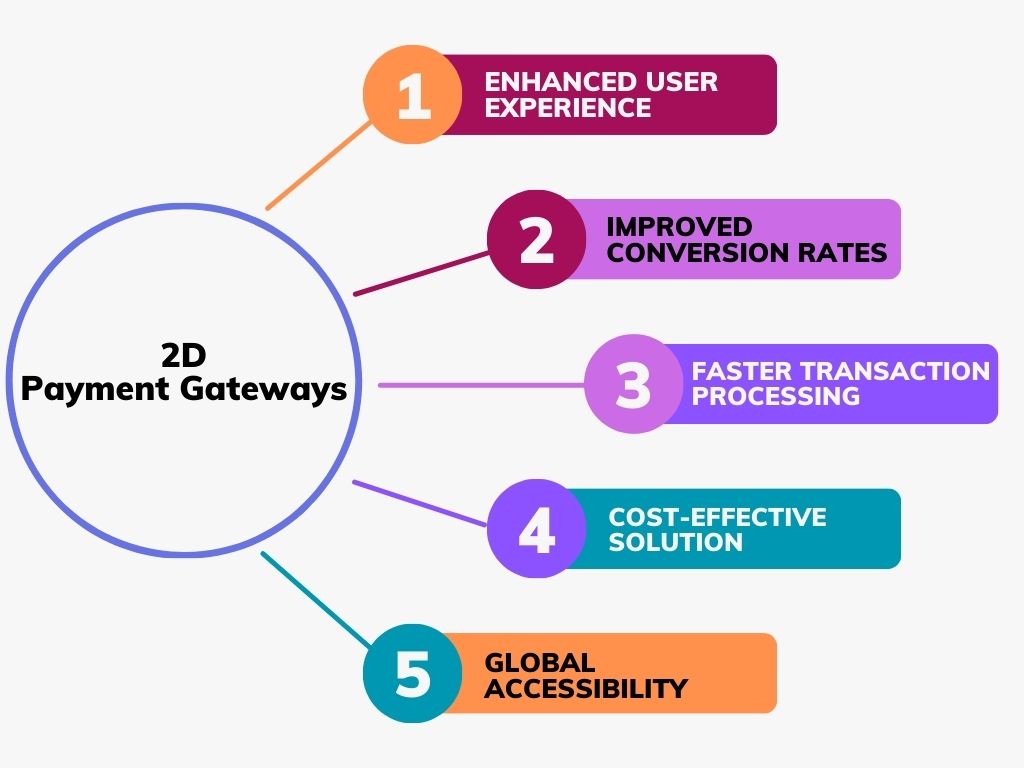

Organizations can significantly benefit from the assimilation of settlement entrances, which simplify the transaction process and improve functional performance. Among the key benefits is the automation of payment handling, decreasing the demand for hand-operated intervention and minimizing human error. This automation enables organizations to concentrate on core activities rather than administrative jobs, eventually enhancing performance.

Additionally, repayment entrances help with numerous payment methods, consisting of charge card, digital purses, and bank transfers. This flexibility provides to a other broader consumer base and urges higher conversion rates, as clients can choose their recommended settlement approach. In addition, payment entrances typically offer in-depth coverage and analytics, making it possible for businesses to track sales trends and customer behavior, which can inform calculated decision-making.

Repayment gateways enhance safety and security steps, shielding delicate economic details and minimizing the danger of fraudulence. Generally, integrating a settlement portal is a calculated relocation that can lead to increased growth, earnings, and performance chances for services.

Enhancing Client Experience

Exactly how can settlement portals raise the client experience? By improving the payment process, settlement entrances dramatically enhance the total shopping journey. They assist in quick and safe and secure purchases, which are essential for today's customers who expect performance and integrity (2D Payment Gateway). With incorporated features such as one-click payments, consumers can complete their acquisitions with marginal initiative, decreasing cart abandonment rates.

Moreover, repayment portals support numerous settlement methods, consisting of credit score cards, digital purses, and financial institution transfers, catering to diverse customer choices. This versatility not just satisfies the needs of a bigger audience however also cultivates a feeling of trust and fulfillment amongst customers.

Additionally, a protected payment atmosphere is paramount. Payment gateways use advanced file encryption modern technologies, guaranteeing clients that their delicate information is protected. This level of protection develops self-confidence, motivating repeat organization and customer commitment.

Furthermore, several repayment portals use real-time transaction updates, allowing clients to track their repayments immediately. This openness boosts communication and reduces uncertainty, adding to a favorable customer experience. On the whole, by executing a effective and safe repayment entrance, companies can significantly improve client satisfaction and commitment, ultimately driving development and success in an open market.

Conclusion

In recap, the implementation of a settlement portal provides countless advantages for organizations, consisting of streamlined transaction procedures, boosted protection, and extensive analytics. Eventually, settlement gateways offer as necessary tools for modern ventures intending to grow in an affordable digital market.

In addition, payment entrances help with a multitude of repayment approaches, including credit history cards, debit cards, and electronic wallets, providing to a diverse client base.

Many payment gateways provide customizable checkout experiences, permitting businesses to straighten the helpful resources settlement procedure with their branding.

In addition, payment portals help with various settlement methods, consisting of credit history check this site out cards, digital wallets, and financial institution transfers. By enhancing the repayment procedure, repayment entrances substantially enhance the overall shopping journey.Moreover, numerous payment gateways supply real-time deal updates, permitting customers to track their repayments instantaneously.